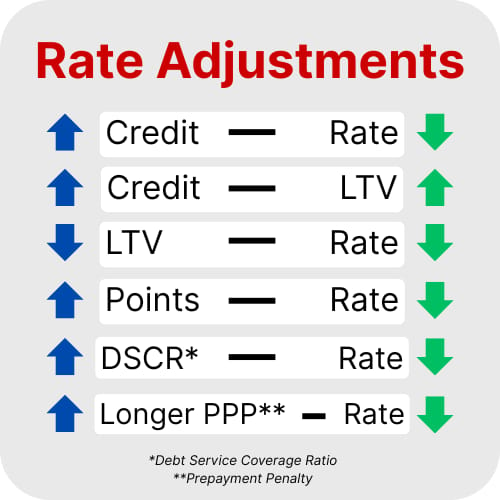

CURRENT RATES

Options to get into the 5’s!

FREE RESOURCES FOR INVESTORS

EXPERIENCES

Not every real estate lesson comes from a win. This week, I’m sharing a true story from the landlord side—one that involved a fire, a lawsuit, an insurance fallout, and a lot of hard lessons. It’s not about blame. It’s about what happens when things go wrong—and what investors need to be prepared for.

A Hard Lesson From The Landlord Side

THE MORTGAGE INDUSTRY

Mortgage Rates Close To 3-Year Lows

Mortgage rates moved modestly lower for the average lender today, but higher for others. The distinction is whether the lender in question made a late-day adjustment yesterday afternoon.

At the time, the underlying market for mortgage bonds was improving somewhat sharply. This prompted several lenders to drop rates before the end of business…

MORE MORTGAGE INDUSTRY NEWS

Rate Drop Triggers Refi Surge - Mortgage application activity rebounded sharply last week as falling interest rates reignited refinance demand and kept homebuyers active, according to the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 9, 2026. The MBA’s Market Composite Index rose 28.5% on a seasonally adjusted basis from the previous week, reflecting a broad-based pickup in borrower activity.

Bond Buying Announcement Leads Surge In Mortgage Apps - The announcement that Fannie and Freddie would buy $200bln in mortgage-backed securities led to a precipitous drop in rates last week. For most of last Friday, the top-tier 30yr fixed rate was at 5.99% for the average lender according to MND's daily mortgage rate index - the lowest in roughly 3 years. And that single day of ridiculously low rates was enough to visibly juice application activity.

THE HOUSING MARKET

Existing-Home Sales Jump 5.1% In December, Strongest Pace In Nearly Three Years

Existing-home sales posted a notable year-end rebound in December, jumping 5.1% to a seasonally adjusted annual rate of 4.35 million, according to the National Association of Realtors (NAR). After adjusting for seasonal factors, December sales were the strongest in nearly three years, marking a broad-based improvement across all four regions. “2025 was another tough year for homebuyers, marked by record-high home prices and historically low home sales,” said NAR Chief Economist Lawrence Yun.

MORE HOUSING MARKET NEWS

Investor Share Of Home Purchases Hits Five-Year High In Q3 - Real estate investors accounted for more than one-third of all single-family home purchases in the third quarter of 2025, marking the highest share in five years, according to the Q3 2025 Investor Pulse Report from BatchData. Investors purchased 34% of homes sold during the quarter, up from 33% in Q2 2025 and sharply higher than the 25.5% recorded in Q3 2024.

The Housing Market Is At A Turning Point: The 3% Mortgage Era Is Fading - For the first time, the number of homeowners with mortgages above 6% has outpaced those with borrowing rates under 3%, according to Realtor.com's latest report on the lock-in effect. The last time rates were under the 3% threshold was between July 2020 and September 2021. Rates haven't fallen below this threshold since 1971.

THE CONSTRUCTION WORLD

Townhouses On Record Run

Townhouses, an alternative to more pricey single-family detached houses, accounted for almost 20% of all single-family starts in the third quarter. Some 46,000 of these attached, mostly multi-story units were started in the third quarter, the National Association of Home Builders (NAHB) reports. Over the previous four quarters, townhouse starts total 179,000, a 1% increase from 177,000 in the prior four quarters.

Growth For Custom Home Building

NAHB’s analysis of Census Data from the Quarterly Starts and Completions by Purpose and Design survey indicates year-over year growth for custom home builders amid broader single-family home building weakness. The custom building market is less sensitive to the interest rate cycle than other forms of home building but is more sensitive to changes in household wealth and stock prices. With spec home building down and the stock market up, custom building is gaining market share.

THE FINANCE CORNER

Failing To Rate Shop Could Cost Homebuyers Thousands

A new Zillow analysis suggests many homebuyers may be leaving significant money on the table by failing to shop around for mortgage rates, even as they spend months searching for the right home. According to Zillow’s Consumer Housing Trends Report, nearly seven in 10 mortgage shoppers submit only one loan application, a habit that can cost borrowers tens of thousands of dollars over the life of a mortgage.

Gold, Silver, Copper Surge As Explosive Rally Sweeps Over Metals Market

Gold, silver, and copper climbed to new highs on Wednesday, extending an explosive rally to mark the first two weeks of January. Gold futures hit a high of $4,650 per troy ounce, marking a 5% year-to-date gain. Wall Street analysts upped their forecasts in recent days in light of the recent US intervention in Venezuela, geopolitical tensions with Iran, and growing questions about Federal Reserve independence.

Thanks for reading,

One Nation Weekly

Good luck to you on your real estate investing journey!