CURRENT RATES

FREE RESOURCES FOR INVESTORS

EXPERIENCES

Welcome to the premiere issue of One Nation Weekly, your source for all things real estate investing. Each edition brings you the latest real estate news, market updates, interest rates, loan products, and investor insights. Plus, we’ll share a Real Estate Investing Experience of our own.

How 1 Deal Turned Into 3

THE MORTGAGE INDUSTRY

Mortgage Rates Improve After Fed Announcement

The Fed cut its policy rate by 0.25% today, and mortgage rates moved lower after the announcement. That said, those two developments are not related. In fact, there was no movement in the bonds that underlie mortgage rates when the rate cut was announced. Instead, the market (and rates) moved in response to Fed Chair Powell's press conference.

MORE MORTGAGE INDUSTRY NEWS

More Buyers Ready to Jump in 2026 - A new survey from RE/MAX finds that 88% of prospective buyers say they are “very” or “somewhat” likely to purchase a home in 2026, although 71% say current market conditions have pushed their plans back.

Investors Purchase 17% of All Homes - Real estate investors purchased 17% of U.S. homes that sold in the third quarter, up marginally from 16% a year earlier. The mostly unchanged investor market share signals that the sluggishness of investor activity mirrors that of the larger homebuying market.

THE HOUSING MARKET

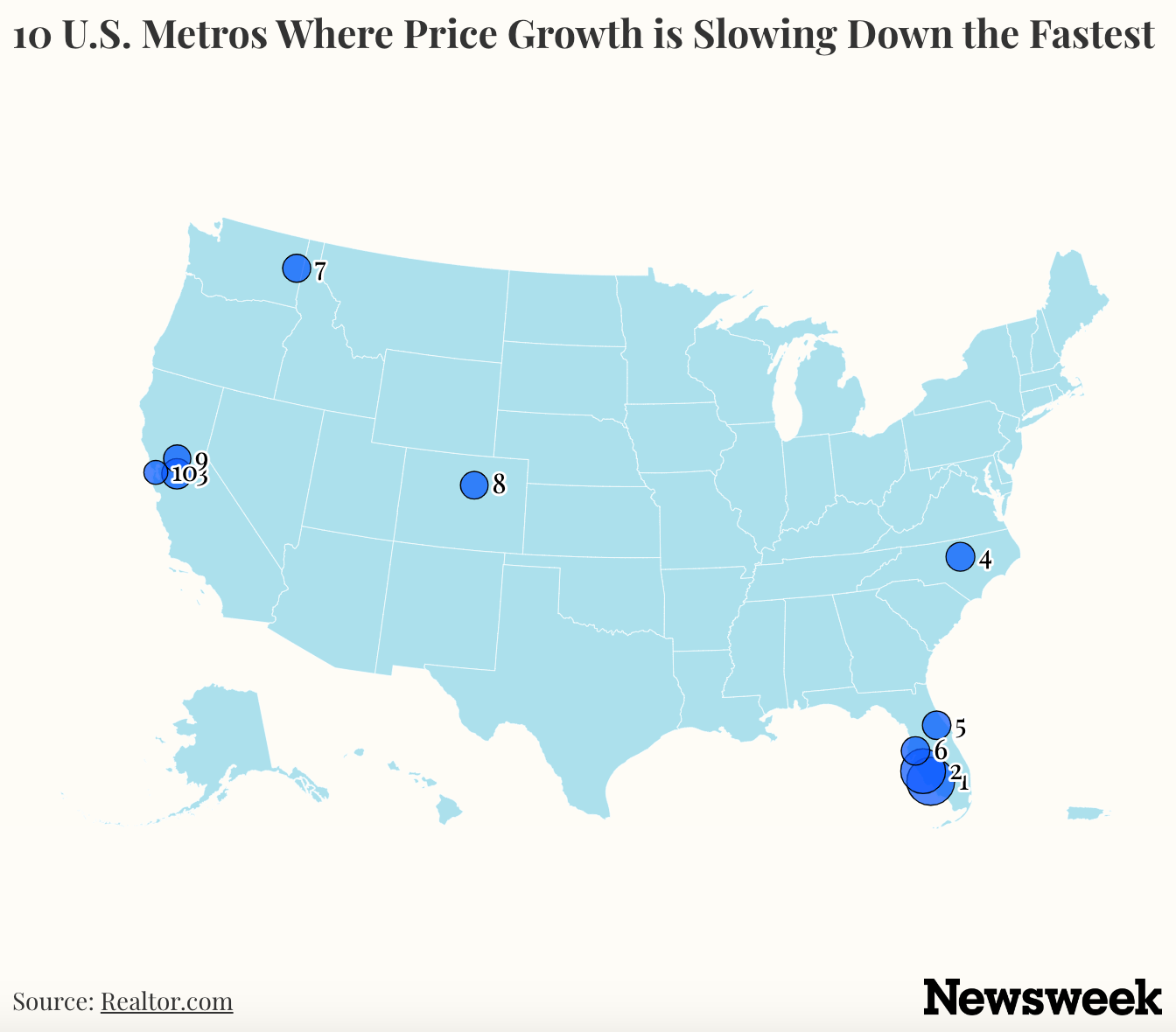

Map Reveals Cities Where Home Prices to Fall Fastest in 2026

Among the top ten U.S. metropolitan areas where home prices are expected to fall the fastest in 2026, four are in Florida and three are in California, according to new analysis by Realtor.com. While at the national level home prices are expected to continue rising by 2.2 percent year-over-year by the end of 2026, prices in 22 cities are forecast to fall, the report revealed.

MORE HOUSING MARKET NEWS

Homeowners Are Still Locked in by High Mortgage Rates - Especially in These 5 Top Markets - Many homeowners who managed to snag mortgage rates well below today's levels are staying put to avoid sharply higher monthly payments—and some of the nation's priciest markets are feeling the strain of this deepening "lock-in effect."

Florida Home Prices Expected to Plummet Next Year - Florida’s pandemic housing frenzy rewrote the record books for soaring prices. Now it’s about to rewrite them again — for the biggest home price falls in the country.

THE CONSTRUCTION WORLD

Construction Labor Market Stable

The count of open, unfilled positions in the construction industry was relatively unchanged in October, per the Bureau of Labor Statistics Job Openings and Labor Turnover Survey (JOLTS). The current level of open jobs is down measurably from two years ago due to declines in construction activity, particularly in housing.

Modular Construction Market Positioned to Reach $155.2 Billion by 2033

Dynamic global demand is shifting from niche pilots to mainstream adoption, driven by government-backed housing initiatives and technological leaps in steel modularity. Manufacturers are scaling production to meet urgent residential needs despite lingering logistical hurdles.

THE FINANCE CORNER

Bessent: U.S. will finish the year with 3% GDP growth

Treasury Secretary Scott Bessent said that it’s been a “very strong” holiday season for the economy and predicted that the U.S. would end the year at 3% real GDP. Bessent said American consumers’ views on affordability have been affected by media coverage of the economy.

Morningstar’s tax-planning and IRA resources for 2026

Preparing your taxes can be stressful, time-consuming, and overwhelming. Giving your tax situation a little attention today will make tax time simpler and less stressful next year. Here are some tips, dates, and resources to get yourself ready for tax season.

Thanks for reading,

One Nation Weekly

Good luck to you on your real estate investing journey!